How was the Special Patronage Dividend Calculated?

Average Daily Balance (ADB) Calculation:

The account average daily balance includes the sum of the average daily balances of all shares and loans (Signature, Vehicle, and Mortgage) for the calendar year, with the exception of evolve Financial Services and IRA balances. For accounts opened after January 1st, their Patronage Dividend is prorated from the account opening date.

The Patronage Dividend is reportable on IRS Form 1099-INT and 1099-MISC each year. All share dividends earned (dividends earned from share account and loan balances) will be reported on IRS Form 1099-INT. It will be electronically deposited into the Savings account for the primary member.

Only primary members receive a Patronage Dividend. Joint members do not receive separate Dividends. Not all primary members will receive a dividend due to non-qualifying factors (see Member in Good Standing Definition below). Organization (Business), Estate, Revocable Trusts and Non-Revocable Trust accounts are not eligible for the Patronage Dividend. The Board of Directors must approve the distribution of the Patronage Dividend each year.

Active Member: Any member with at least $15.00 in their regular share account.

Member in Good Standing Definition: Any member with at least $15.00 in their regular share account, who does not have a negative balance in any other credit union deposit account after 7 days, who did not have a delinquent loan by more than 10 days as of December 31st, and who has not previously caused the credit union a financial loss of any kind.

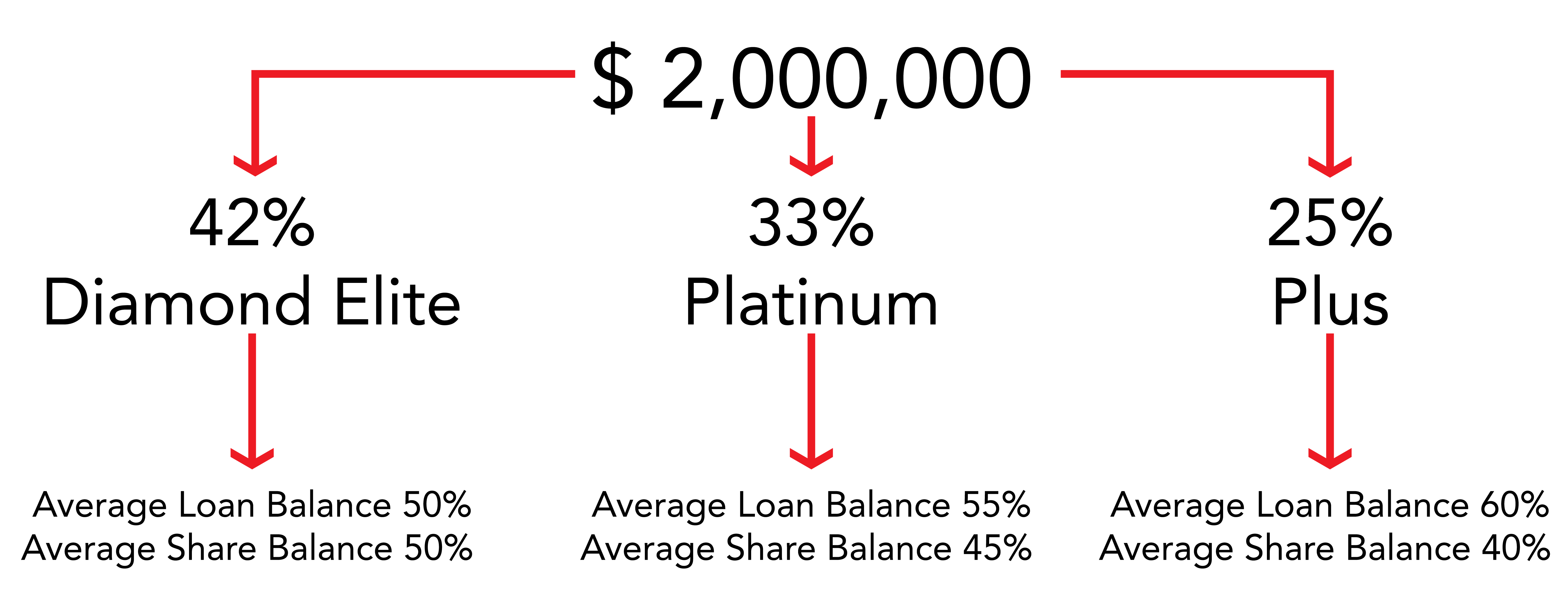

Patronage Dividend Estimate below is based on a total of $2 million payout.