Blog Article: April 27, 2023

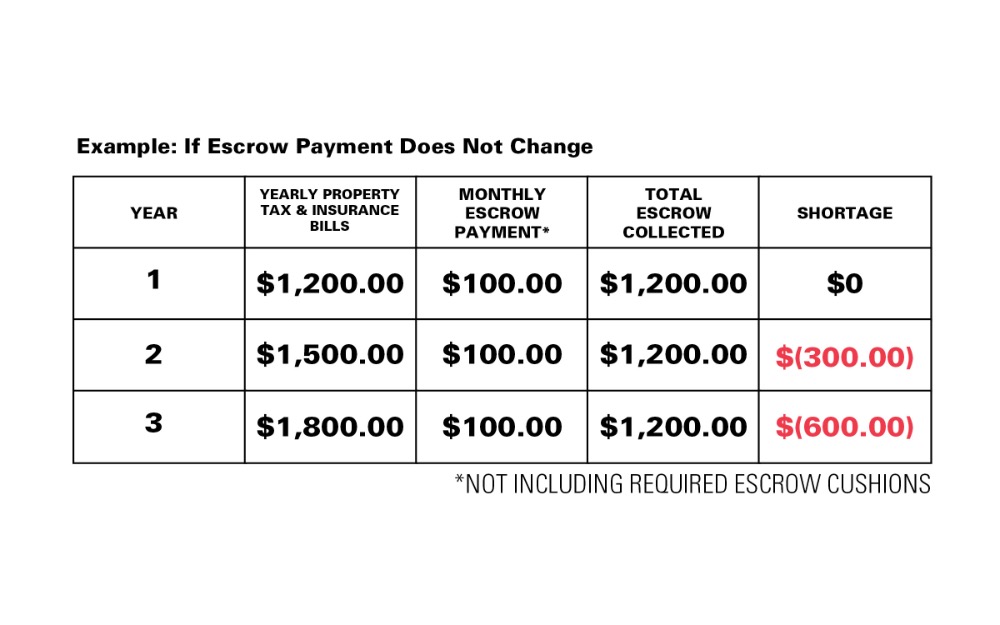

If you’re a homeowner, you’ve probably heard the term “escrow” before. But do you really understand what it means? When you take out a mortgage to buy a home, part of your monthly payment goes towards property taxes and insurance. To ensure that these expenses are paid on time, an escrow account is set up by your mortgage lender to pay for your property taxes and insurance. Every year, your lender will conduct an escrow analysis to determine if the amount you're paying into your escrow account is sufficient to cover the upcoming year's property taxes and insurance premiums. If it's not, you'll be required to make up the difference in a lump sum payment or through increased monthly payments.

- What is an escrow analysis?

An escrow analysis is a review of an escrow account's activities over the past 12 months and projections for the next 12 months. It is performed annually by lenders to determine if the current monthly deposits will provide sufficient funds to pay taxes and insurance for the next full year, as well as provide the appropriate cushion. - What happens if there is a shortage in your escrow account?

If there is a shortage in your escrow account, your lender will increase your monthly mortgage payment to cover the shortage. You also have to option to pay the shortage. If you choose to pay the lump sum, your lender will typically give you a few weeks to pay the shortage. - What happens if there is a surplus in your escrow account?

If there is a surplus in your escrow account, your lender may refund the extra funds to you. Surpluses under $50 will be kept in the account and reduces your payment.

In summary, an escrow analysis is a review of your escrow account to ensure that there are enough funds to cover your property taxes and insurance premiums. If there is a shortage or surplus in your account, your lender will take appropriate action to rectify the situation.

.jpg)